So we are goanna tell you the truth about why going into business with family members is a very bad idea.

So we are mainly working with smaller family businesses and we have seen first hand how tricky the minefield is to navigate when it comes to family businesses.

So it is very easy for parents who have started their own business from the ground up that they would like their children to take it over at some point.

This might all sound very good on paper but it is very seldom as easy as it seems and sounds.

Very often there is a huge pressure to take over the family business that also affects the normal family life between siblings and parents.

When we are often asked if a company should be handed down to the children our normal answer is NO!.

The only time we support this idea is if there is only one child who will take over the family business.

And this can then be that there is only ONE child, or that the other siblings gets bought out by the parents early on.

Usually we come in as business advisers when there is problems in a family run company or they are in need of outside consulting to solve severe issues.

Very often there can be a situation where a brother and a sister has completely different plans and visions for the family business.

And if they own 50% each then nobody really has the tiebreaker.

We usually recommend that an outside party own anywhere from 2-5% of the business and they can then take on the role as the tiebreaker.

Also making sure that the children actually wants to take over the family business is extremely important, because otherwise it will fail when they feel pressured going into the business.

In many cases we would like to see family businesses sold when the first generation retires, this would save a lot of heartache for many families.

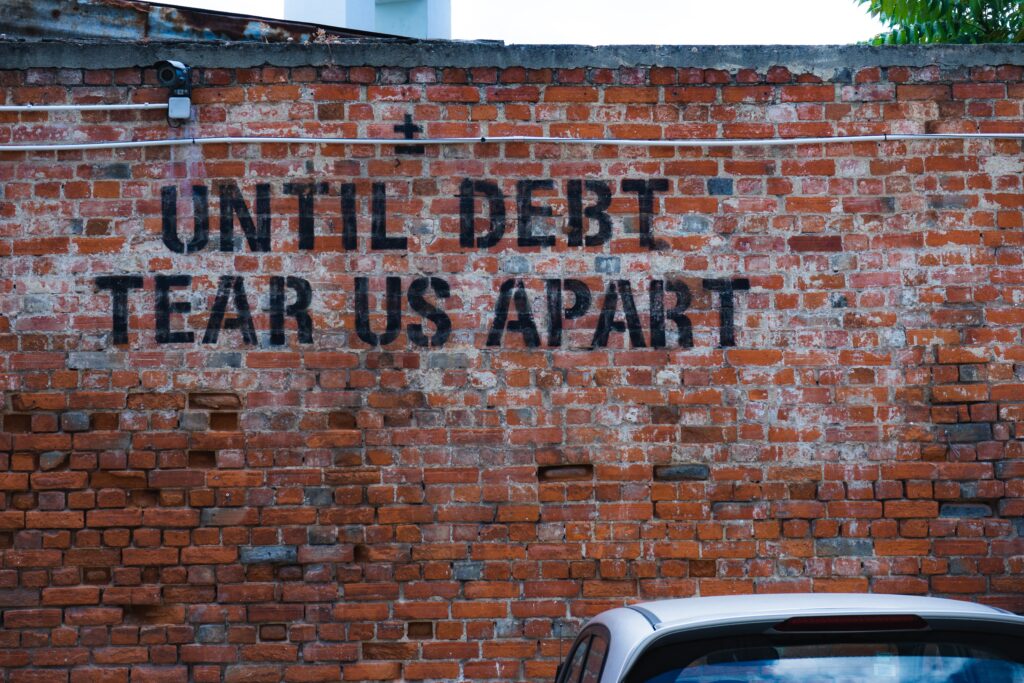

We have seen and we see on a yearly basis how money and family businesses destroys families forever.

So NO it is not a good idea to go into business with your family members and in many cases to hand over a business to several siblings.

Yes there are exceptions to this rule where family members work well together and it flows fine, but those are far and few between.

Ask anybody who has worked in a family business about the conflicts that they have had with family members over visions and financial aspects of the business.

Also usually when a business does better these conflicts are not as visible, but when a family run business does poorly these conflicts becomes very real and very public.

Now with the Covid-19 hitting a lot of business that are run as family businesses like restaurants, coffee shops, small hotels and vacations type of businesses.

We can see the horror that many families goes true when they are losing their business.

It is also very dangerous for familes to have several people depending on their income from ONE business.

It would in many cases be better to separate the business into several parts.

So if the shit hits the fan in one business, there are other family businesses to relay on for income.

So for instance if you start a restaurant and if goes well, then maybe start also a food truck or two, and then a coffee shop on top of this.

And if you have 3 children then if they are interested let each one of them run one of the businesses when you retire.

So Dividing up companies by adding your own LLCs or Inc:s is a good idea for risk management.

So what do you do if your family is already broken from a failed business or a huge fight over a family business.

We have created a mending fence plan for family members who have not spoken in a long time, and who have lost touch due to a family business.

What we then do is that usually another family member reaches out to Mrlifeadvise consulting and says that Billy and Gina have not spoken to each other for years due to this thing happening back then.

What we then do is that we contact both parties for a meeting with them first individually and we then discuss if they would be willing to meet their sibling or family member for a coffee with us as mediator, or online.

And very often there is a lot of hesitation involved and we then just simply explain that this is your family member dont you owe it to yourself to make sure that this relationship is over for good?.

And then we meet for coffee once a month and if it all goes well we make it once a week for 2h.

Or we have this meeting online to begin with.

So very often nobody reaches out to their sibling after a huge fight and then the years go by, and very often when we speak to business owner as advisers they one thing many of them mention is that i wish that i would have mended fences when my sibling was still alive.

We had a stupid fight, about things that does not really matter in life, and i wish that i could take it all back.

And sometimes it is to late, even when the sibling is alive.

Sometimes there has just been too much water under the bridge.

And then those relationships can not be salvaged.

Very often it is also depending on what has happen in the first place, if these relationships can be salavaged or not.

We can just mention one case where the oldest brother of 4 siblings stole all the company funds and let the business die and the other siblings suffered for years due to this greed of one brother.

So in these kind of cases there is no walking it all back, what is done is done.

So in general we do not recommend family members to go into business together or the first generation to hand over a business unless everything is structured to perfection.

If you have a small business and you need business advise, feel free to check out https://mrlifeadvise.com/shop/ different online options in our shop.

We can also recommend that if you are now looking to lose some weight this year that you check out one of our clients very smart blueprint book on Amazon , see the link here below.

Take care out there.

https://www.amazon.com/Loseweightcheap-Scandinavian-weight-formula-actually-ebook/dp/B07TP3LKHB

Mrlifeadvise.