So very often we read about the success stories in magazines and online from people who made it and made it big!.

But very seldom do we hear about the business failures, more than just a line in the local paper or similar.

More than 50% of all small business owners fail within the first 5 years time.

If you managed to survive the first 5 years then usually that business is goanna be around for a long time.

There are a few very important things that you should always take into consideration when you start a business of any kind, and also along the way as the business grows.

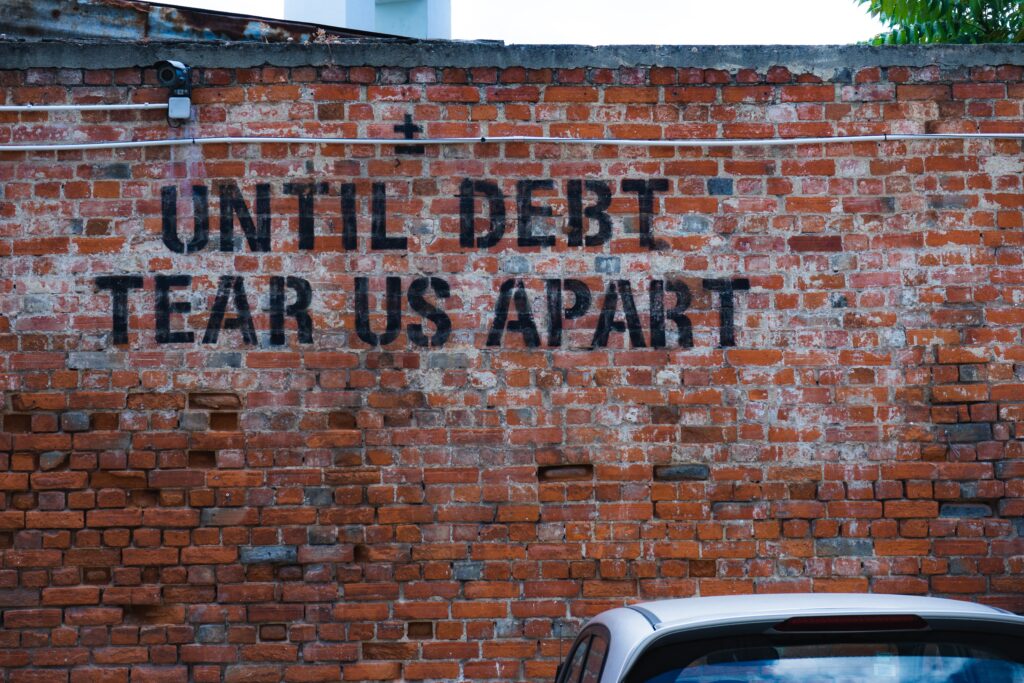

No1: Never guarantee a debt in an INC or an LLC, which in many cases means that you have to put your house or other private assets up as collateral for a commercial business loan.

And the manin reason for that is that 50% of all start ups fail within the first 5 years of opening their doors.

CPAs and business advisers likes to point out that if you put your house up as collateral the interrest on your loan can be as low as 3-5%.

So if you have a commercial loan without any collateral the interest rate is usually from 12-22% which is very high.

So we totally understand that side of the argument, but if you go into business it is a huge risk that you end up losing your home if your business fails.

And if you do not put up you home, then you have something to fall back on and somwhere to live.

There are few things that are more draining as a business owner than when your business goes under you also end up losing your home and having to move in an already extremely stressfull situation.

So taking out a high interest commercial loan is almost always the way to go unless you are 100% sure that you will not end up losing your business.

These cases are very rare, we could say that they are loans taken out to cover POs (purchase orders) for customers or similar cases.

Nr2: Never sign any document that you are personally also liable for the business loan, because if you are, you also need to file personal bankruptcy to get rid of that debt.

So very often you are pressured by lenders to co-sign for your business and this is a very bad idea.

Often they use the argument that do you not believe in your business?, and that is a very weak argument to use on a business owner.

Who could foresee the Covid-19 pandemic hitting the world in March 2020?.

So anything can happen to your business this just a fact!.

Nr3: The third thing you should know that even if you have very good coverage insurance wise, you have to fight tooth and nails to the bitter end with most insurance companies to get what you are entitled to according to your insurance agreement.

And the reason for this is that it is cheaper to drag you to court than to pay out your claim, this is something that we have seen happen all over the world when companies had pandemic insurance and Covid-19 HIT.

So you can never trust your insurance company they are all ASS HOLES ALL OVER THE WORLD.

And their business model is to collect money on premiums and not to pay it out when you need it.

The only customers that gets paid are the lawyers because they will sue immediately and they know the law, so the insurance companies like to harass small business owners, it is much easier to pray on the weaker ones.

No3: Make sure that if you for whatever reason have to personally guarantee a business loan that you never agree to sum larger than 2 years net salaries (the amount you could make working as an employee), then it will take you 2-3 years to pay back if you work two jobs.

No4: Try and avoid blaming yourself for the business failing, take away the good parts and learn from the bad parts of conducting business.

No5: Under no circumstances should you start self medicating with drugs or alcohol after a failed business, this will just lead you down a rabbit hole that many never returns from.

So fresh air, exercise , mindfulness spending more time with your pet/pets will help you true what many says are the worst times of their lives.

No6: Take a break from running your own business, go back to employment for a 2-3 year period and find your balance that way.

This is usually a good way to recover both financially and mentally by working for a corporate rather than immediately after a failed business jump right back into a new one.

No7: If you have to file for chapter 7 or chapter 11 bankruptcy make sure that you have the right advisors by your side like a good CPA or a similar professional who can guide you true it step by step.

No8: Be very careful when lenders and creditors reaches out to you after a failed business.

Very often you are drained financially and also emotionally and many creditor and lenders tries to use that to their advantage when reaching out to you.

So never agree to anything over the phone or just because you feel guilty for failing and leaving debt behind to other companies and lenders, this is part of doing business.

No9: Work two jobs to keep you from sitting at home going over why your business failed, you should learn from the mistakes and do a proper due diligence after a few months time to figure out what the root cause for the failure was.

But once the business has failed you can not fix it anymore so driving yourself crazy by dwelling over things will not get you anywhere.

No10: If you feel that you are ready to start a new business after awhile, a good idea is to keep your daytime job and start the company while working with it in the evenings and on the weekends , this way you ease into it rather than jump from the deep end into a risky venture again.

If you feel that you need expert advise, then feel free to contact us we offer many good packages for small and medium sized business owners and to management https://mrlifeadvise.com/shop/

https://mrlifeadvise.com/shop/

One our clients has written this kindle e-book and we highly recommend it to anybody wanting to stay healthy and in shape, or wanting to lose-weight.

Take care out there and stray strong.