So this story we are telling you about today, is about one of our long-term clients from our business consulting division, and we have his permission to tell the story publicly in this article.

Eric is an old client of ours, and he is 43 years old and he runs a smaller construction and roofing business with 20+ employees.

His company does 3 million dollar a year in turnover and he is the sole owner, and the company has zero debt.

He started the company 21 years ago at the age of 22 so he is a self made guy.

So these are the positive thing about Erics financial situation.

He has a salary of 500.0000 dollars a year and he pays 40% in tax and he lives with his two dogs in a 3 bedroom town house.

Eric has a net income of 300.000 dollars and he has fixed costs of 80.000 dollars a year and then comes the cash purchases of food and other things.

So now you would think if you do the math that maybe he has invested and saved almost 200.000 dollars a year for many years so this guy is doing really well!.

Here comes the bad news with Eric, he is a gambler and he plays both online casinos and he bets heavily on sports, where NBA,NFL,NHL and European soccer is his favorite’s to bet on.

This heavy gambling takes place in Erics life when he comes home from work, and before he goes to bed he bets on many objects that takes place over night.

We have had several conversations with Eric over the past 9 years that he has been a client of ours, that maybe it would be a good idea to stop gambling and just invest his money on the stock market and into real estate instead.

Eric has not been willing to do that, and he has told as that he wants to continue betting on sports because he likes it to much.

So what has now changed?, in April Eric lost his best friend to Covid-19 and he was devastated and he wanted to pay of his late friends mortgage to help the two children and the widow out.

Here comes the wake up call, Eric figures out that he was no savings , no stocks or bonds that he can sell to cover the mortgage and no 401K to take money out of.

Eric now contacts us and demands a meeting the same day, and his request is that we take over his finances for 3 year period, true a wide Power of attorney.

So he requests that we take care of his personal finances and in his business finances.

He also ask us to put him on NEGA, our gambling treatment program that we have developed over the past 20 years time.

So in May this year Mrlifeadvise consulting takes over his finances together with a CPA to make sure that we handle everything correctly.

So after having lost around 3.7 million dollars over a 20+ year period Eric is now for the first time in his adult life free from the gambling demon, and he has opened up a trading account to buy stocks from each monthly paycheck as a type of 401K savings account.

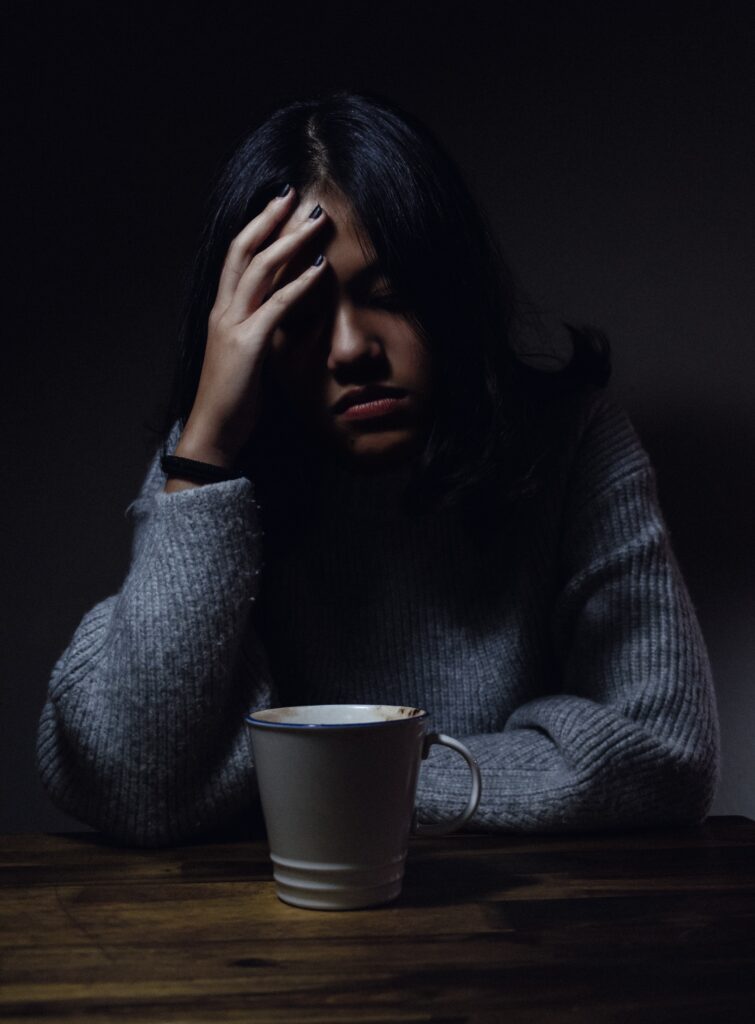

He has had many emotionally bad days and some days where he has been upset with himself for wasting all this money over all this time.

And if he had invested these money into global index funds his portfolio would have been worth anywhere from 6-9 million dollars in 2020.

Instead of like now having almost nothing in his savings account.

So Eric is still one of the lucky ones, he has a company that are still doing 85% of the business he had before COVID-19 , and he still has time at the age of 43 to change his life around.

He is one of these cases that we do not here about, since he has not hit rock bottom , because he has been able to always pay his bills and take care of his business true all these years.

But if something would to happen to his business and it would go under then ,Eric would have nothing saved up for a rainy day.

So even if you are not a gambler who have accumulated debts, you should ask yourself do i have any saving or do i spend all my loose money gambling?.

Erics father was a lawyer with a very serious gambling problem when it came to OTB/Horse betting and he developed also a heavy drinking problem and he died pennyless at the age of 72 years in a studio apartment and he did not have more than 4 dollars in assets, so Eric paid for the funeral.

So our read on why Eric had his wake up call, is because when he had to attend his best friends funeral and when he could not just pay away his best friends mortgage in a day, he saw his own future life flash before his eyes, that maybe he would end up in a studio apartment penny less 30 years from now if he does not stop gambling today!.

So stopping before hitting rock bottom with any addiction, is always the best thing you can do and always ask for help, you will not be able to white knuckle it on your own!.

Today Eric called us, and said that he feels better than ever, he sleeps 8 h a night he does not wake up thinking to himself how are the games going that he has a lot of money riding on them.

And he spends more time outdoors hiking with his two dogs, and takes his deceased friends kids out on activities every weekend(he is the god father).

Eric also told us that he is so stress free on a personal level, the business side he can always deal with, but the personal level is something that he feels now looking back at his life that the mornings waking up when he had lost 12.000 dollars on bad sports bets and going to work and faking a smile to keep the spirits up towards his workers was difficult.

So waking up stress free is something he really enjoys, and he is now paying off his best friends mortgage on their house on a monthly basis.

So if you want to help somebody, try and clean them up and get them treament, you can do so much by just being there and helping out, going to AA,AN,GA and other meetings is so important and many times people need a push to take that step, they are not always able to make that decision on their own!.

It takes a lot of gut from a 43 years old successful business owner to go and ask for help with his finances and this is not a sign of weakness but actually a sing of strength that you reach out for help!.

So if you know anybody who has a gambling addiction, then you should really check out our program NEGA(NEVER EVER GAMBLE AGAIN) here attached and in our store.

So take care everybody.

Mrlifeadvise.