Housing crash of 2022!.

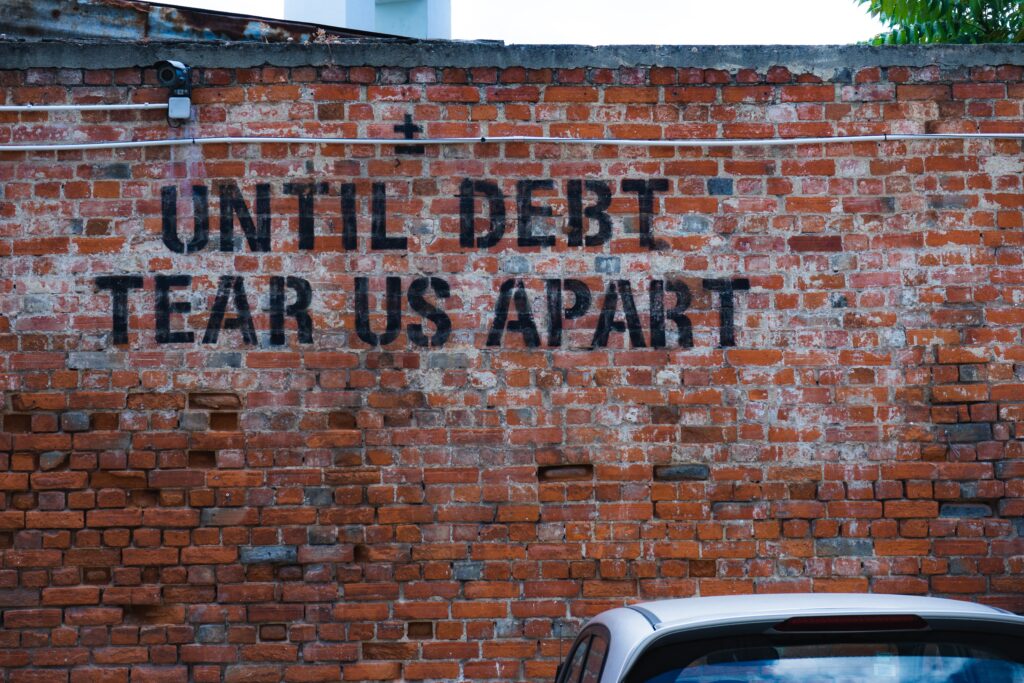

Okay guys we are now reliving some what the housing crash of 2008.

The difference is that in 2008 there where a lot of subprime loans that should never have been issued in the first place, but where anyway.

In 2022 the situation is quite different.

We have been warning for over 18 months time that we will see a big market correction coming when it comes to real-estate in many places around North-America.

What we saw during the pandemic was that people where buying homes unseen for record prices not doing proper due diligence on the property itself, or on the area they where buying in!.

The pandemic made it very scary for a lot people to live in the city and a lot of folks where moving out to the suburbs or to a different state altogether.

Normally when you buy a home you really think it true and most buyers are taking their time looking at different areas and many different types of homes in their price range.

Also comparing comps in the area you are looking to buy in, is usually done by almost everybody.

During 2020-2021 what happen was a feeding frenzy into home ownership and many real-estate agents used urgency into their advantage against homebuyers, and a lot of first time home buyers are now under water with their mortgages.

Many homes where put on the market for 400.000$ and sold for over 600.000$ that in it self is a huge problem.

The home was worth 400.000$ but with many buyers you had bidding wars on almost every property listed under 1 million dollars.

Also that large property investment groups where buying up hundreds of properties in one area at the time to fix them up and rent them out did not make the prices any better for first time home buyers.

With the inflation being as high as it is today in June 2022, and FED raising the rate to start with by 0.75% , will see new construction going down even more.

And with the lumber prices and part shortages we wont see as many new construction as we normally would see in the upcoming 36 months time!.

And with the mortgage rates between 6-8% in the upcoming 12 months period we are seeing a lot of difficulties’ coming the home owners way.

If you bought a house in 2019 for 400.000$ you would pay 484.000 over your 30 year mortgage with a 3% interest, now with 7% you will pay over 800.000$ for the same home.

So we are seeing the real inflation chaos hitting the market right now.

Not to mention the heating and cooling costs with the high prices of energy these days, there is very little you can do as a home owner in 2022.

How much will the houses drop in price?, we have said up to 40% in certain areas and for certain home types.

If your home is expensive to heat and expensive to buy, the market will not be there over next few years time.

Two types of real-estate will always sell and that is very high end, all cash buyers and then lower prices properties under 200K.

But most properties are not of this type.

We will see a foreclosure rate that we have not seen since 2008-2009.

But this time it will be normal families with good incomes and a good credit score, who will suffer the most.

The perfect storm is here with gas prices, heating prices, food prices, and an inflation of 10%´+.

Not to mention a lot of layoffs in the IT and better paying trades, so a lot of highly skilled workers will soon be unemployed.

And then they will not be able to pay the mortgage and two car payments.

The 2008 housing crash was fueled by the subprime (scam) where many first time home buyers was lured into buying homes with very little down, and then the interest payments ballooned after the first 18-24 months time.

Now what is the solution for all the good people who have bought a house in 2020-2022 and are now being considered house poor?.

We can as consultants do certain things online, but we always suggest that you go and see a local financial adviser to see if a chapter 7 or a chapter 11 bankruptcy is a must for you.

Because when you default on a mortgage and the property gets sold for less than it is worth you will still be sued for the rest balance.

Many people around the world, thinks that you just leave the keys with the bank and you are done with the property, nothing could be further from the truth!.

And your credit score will go down the drain very quickly.

Which will make it difficult to even rent a home in this current market.

The other way out under from a mortgage is to sell the home at a loss and then eat that cost over time.

The third option is to sit still and do a few moves, but basically you make that decision to live house poor for maybe a decade.

This means no vacation’s, you pick up that extra job and if possible rent out 1-2 rooms if you have the space.

The credit card debt is going up every single day and it feels like credit cards are the only way many people can make ends meet in June 2022.

If you bought a house for 800.000$ in 2020-2021 and it is worth 500.000$ right now, as long as you dont have to sell it right now, you have not lost any money yet.

So if you can keep up with the mortgage payments by all means do so, that is the best solution for most homeowners.

You will most likely never make money on your property but you might be able to recoup your initial investment.

And right now is not the time to buy a home, and no matter how much rent goes up, keep renting until the mortgage rates are down to 4% again.

We are always here for you as small to medium sized business owner or if you are employed and are just looking for consultants to help you move your life forward.

All of you who are looking to buy a home, but have yet to do so, read our pdf-file on everything you need to know as a first time homebuyer.

See the link here below.

If you are looking to lose-weight we can strongly suggest one of our clients programs.

You find it in the link here below.

https://lose-weightcheap.com/shop/

Take care guys.

Mrlifeadvise.